Corporate Issuers Up Their Game; Can Investors Keep Up?

When it comes to ESG reporting and establishing a sustainability strategy, it’s clear that companies are stepping up their game — and just in time, as there is an avalanche of disclosure requirements coming their way. It’s coming for investors too, who may find that an energized base of issuers knows a thing or two about ESG data reporting.

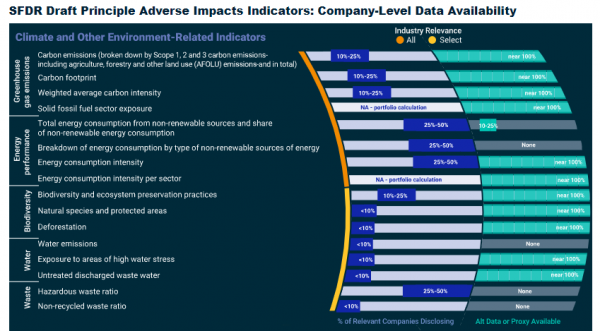

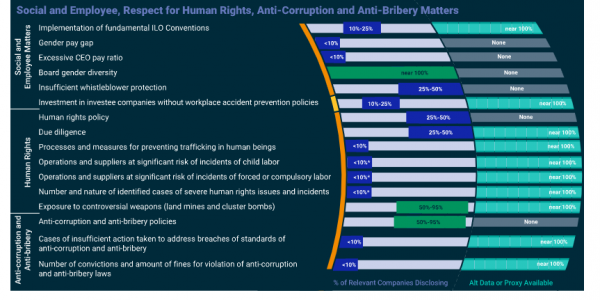

Institutional investors may need to report on an array of new ESG metrics for their portfolio companies if the European Union’s Sustainable Finance Disclosure Regulation (SFDR) is finalized in its current form. Even though the current draft says the requirements wouldn’t kick in until March 2021 at the earliest,2 most companies are not prepared for this possibility. The table below lists the 32 primary adverse indicators that would be required in the current form of the regulation, together with MSCI ESG Research’s assessment of data availability for constituents of the MSCI ACWI IMI. It’s no small task that lies ahead. But from where we sit as intermediaries between investors and corporate issuers, it’s clear that companies are stepping up their game.

Read more about this article here